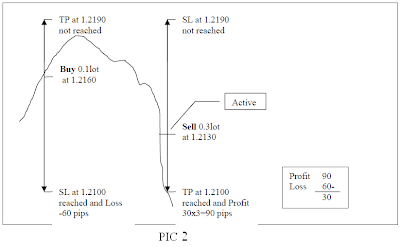

1. Just for simple explanation i assume that there is no spread. Take position with any directions we like, example: Buy 0.1 lot at 1.2160. At the same time or a few seconds after placing Buy, put Stop Sell 0.3 lot at 1.2130. Attentions the Lots.

2. If the TP at 1.2190 not reached and the price goes down and reach SL or TP at 1.2100 then we have profit 30 pips because Stop Sell has become an active Sell before.

2. If the TP at 1.2190 not reached and the price goes down and reach SL or TP at 1.2100 then we have profit 30 pips because Stop Sell has become an active Sell before. 3. But if TP and SL at 1.2100 not reached and the price goes up again, we have to had Stop Buy already at 1.2160 to anticipate. At the time Stop Sell was reached and became active Sell 0.3 lot (pic: number 2), we have to immediately place the Stop Buy 0.6 lot at 1.2160 (pic: number 3).

3. But if TP and SL at 1.2100 not reached and the price goes up again, we have to had Stop Buy already at 1.2160 to anticipate. At the time Stop Sell was reached and became active Sell 0.3 lot (pic: number 2), we have to immediately place the Stop Buy 0.6 lot at 1.2160 (pic: number 3). 4. If the price goes up and reach SL or TP at 1.2190, then we have profit 30 pips too.

4. If the price goes up and reach SL or TP at 1.2190, then we have profit 30 pips too. 5. If the price goes down again without reaching any TP, then continue anticipating with Stop Sell 1.2 lot, then Stop Buy 2.4 lot,…and next. Continue this sequence until we meet the profit. Lots : 0.1, 0.3, 0.6, 1.2, 2.4, 4.8, 9.6, 19.2, 38.4 and 76.8.

5. If the price goes down again without reaching any TP, then continue anticipating with Stop Sell 1.2 lot, then Stop Buy 2.4 lot,…and next. Continue this sequence until we meet the profit. Lots : 0.1, 0.3, 0.6, 1.2, 2.4, 4.8, 9.6, 19.2, 38.4 and 76.8.6. At this example i use 30;60;30 configuration (TP 30 pips, SL 60 pips and Hedging Distant 30 pips). Otherwise we can try use 15;30;15, 60;120;60. Also we can try to maximizing profit by testing 30;60;15 or 60;120;30 configurations.

7. Considering the spread, choose the pair are most tightest spread like Euro/Usd. Usually the spread is only around 2 – 3 pips. More tight the spread, more absolute the winning we got. And I think I found the “Never Loss Strategy”…let the price move to anywhere he likes, we’ll get the profit anyway.

0 comments:

Post a Comment